28+ loan to debt ratio mortgage

Web A car loan payment is 440. Student loan payments are 370.

List Of Top Personal Loan Providers In Machilipatnam Best Personal Loans Online Justdial

Were Americas 1 Online Lender.

. Youll usually need a back-end DTI ratio of 43 or less. Web Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower. Get Instantly Matched With Your Ideal Mortgage Lender.

Comparisons Trusted by 55000000. Total monthly mortgage payment for your new loan of 186700. Web To determine your debt-to-income calculate.

800 in monthly housing costs. Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. Dollar amount of monthly debt you owe divided by dollar amount of your gross monthly income. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Simplify Your Finances Upgrade Your Home or Pay for Expenses. For example if you. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Ad Highest Satisfaction for Mortgage Origination. If your home is highly energy-efficient. Web The two key numbers in this calculation are Johns mortgage payment of 1400 and his monthly income of 6000.

Move quickly on your Northeast land purchase with a simple online loan application. Debt-to-income ratio total monthly debt paymentsgross monthly income. Review 2023s Top VA Home Lenders.

Web Debt-To-Income Ratio - DTI. Ad Weve Researched Lenders To Help You Find The Best One For You. Web DTI example calculation.

Web A 125 monthly personal loan payment. Simplify Your Finances Upgrade Your Home or Pay for Expenses. Ad Get A Low Rate On Your ARM Today.

Your total monthly debt obligation is 292200. Our Reviews Trusted by Over 45000000. Web Back end ratio looks at your non-mortgage debt percentage.

Ad 10 Best House Loan Lenders Compared Reviewed. Web 1 hour agoIn 2022 the Federal Housing Finance Agency FHFA announced mortgage lenders that want to issue conforming loans will need to transition to using the. Apply Now To Enjoy Great Service.

Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances. Ad Our Team Spent Over 400 Hours Choosing and Reviewing the Top VA Loan Providers. Compare Apply Directly Online.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Compare up-to-date mortgage rates and find one thats right for you. Lock Your Rate Today.

Ad Northeast land financing with flexible payments to meet your cash flow needs. Lenders would like to see the front-end ratio of 28 or less for conventional loans and 31 or. Ad Choose Discover for Competitive Rates Personalized Service.

His housing expense ratio is a little more than. Ad Choose Discover for Competitive Rates Personalized Service. Web Here are debt-to-income requirements by loan type.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Principal interest taxes and insurance. You have a pretax income of 4500 per month.

Your total monthly debt payments including your credit card payment auto loan mortgage.

Understanding Automated Loan Approval In Just Minutes Mutual Home Mortgage

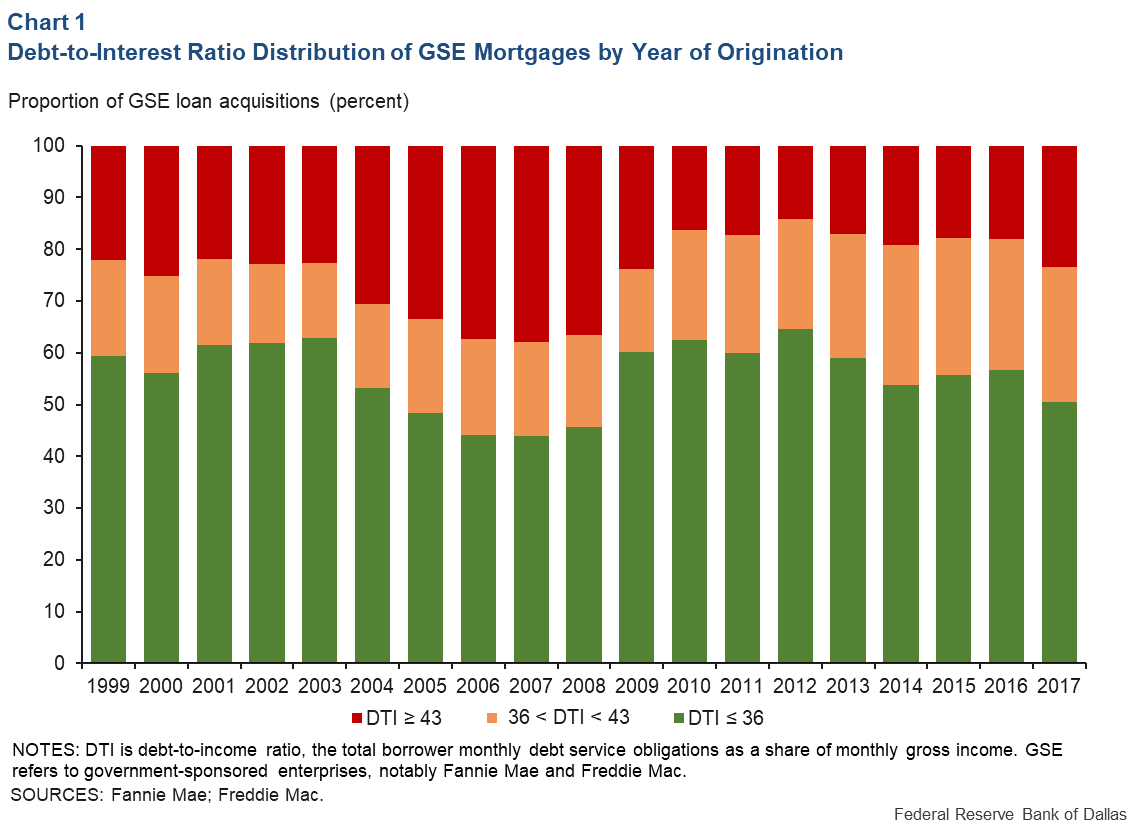

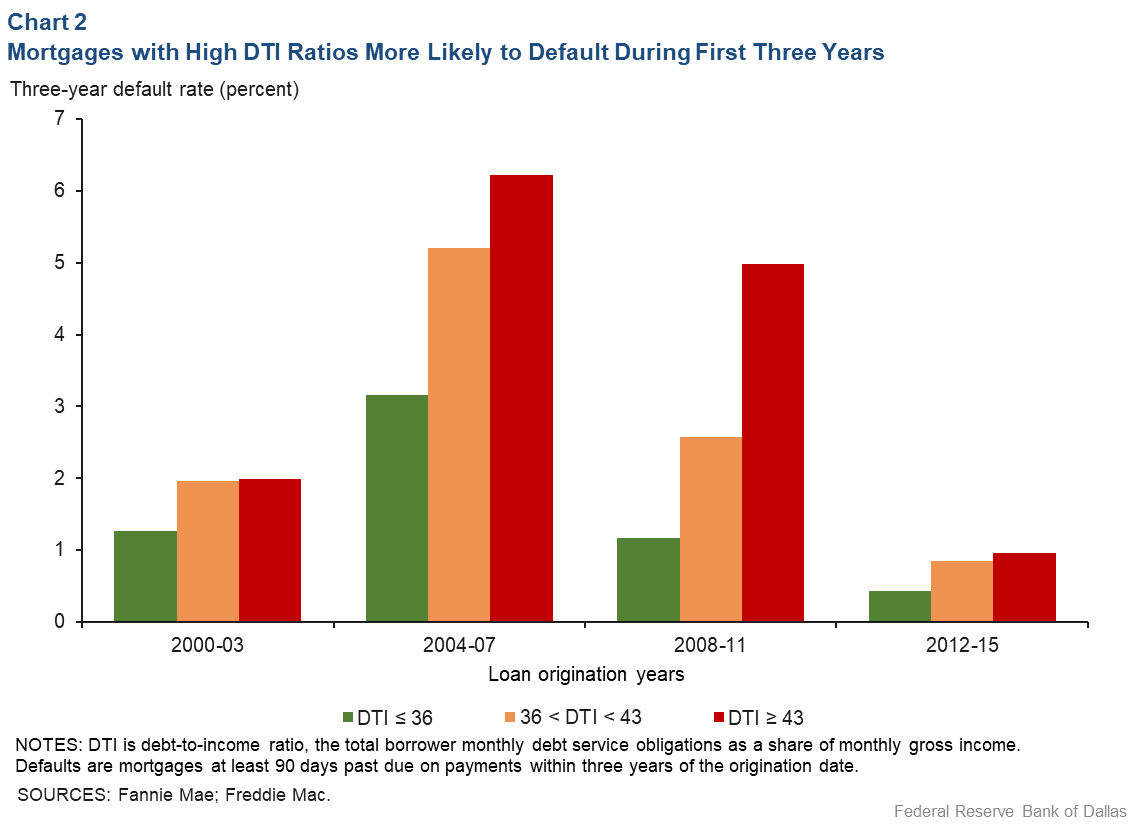

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Debt To Income Ratio Crb Kenya

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

Debt Income Ratio Calculator Front End Back End Dti Calculator For Mortgage Qualification

How To Calculate Your Debt To Income Ratio For A Mortgage

80 Mlo Financial Group Mortgage Real Estate Help Ideas Mortgage Financial How To Plan

Mlo Financial Mlofinancial Profile Pinterest

Pendergraph Development Llc Hud Map Tune Up Ii Workshop September 19 20 Ppt Download

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

28 36 Rule What It Is How To Use It Example

America S Mortgage Debt Spiral Accelerates To All Time High

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

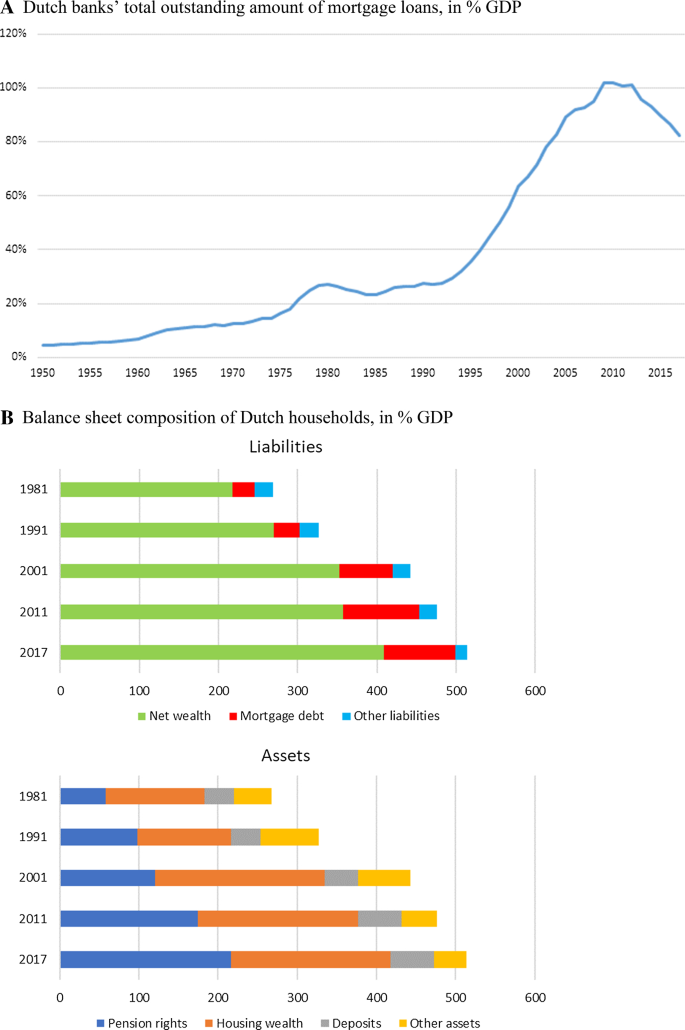

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

Exhibit 99 1

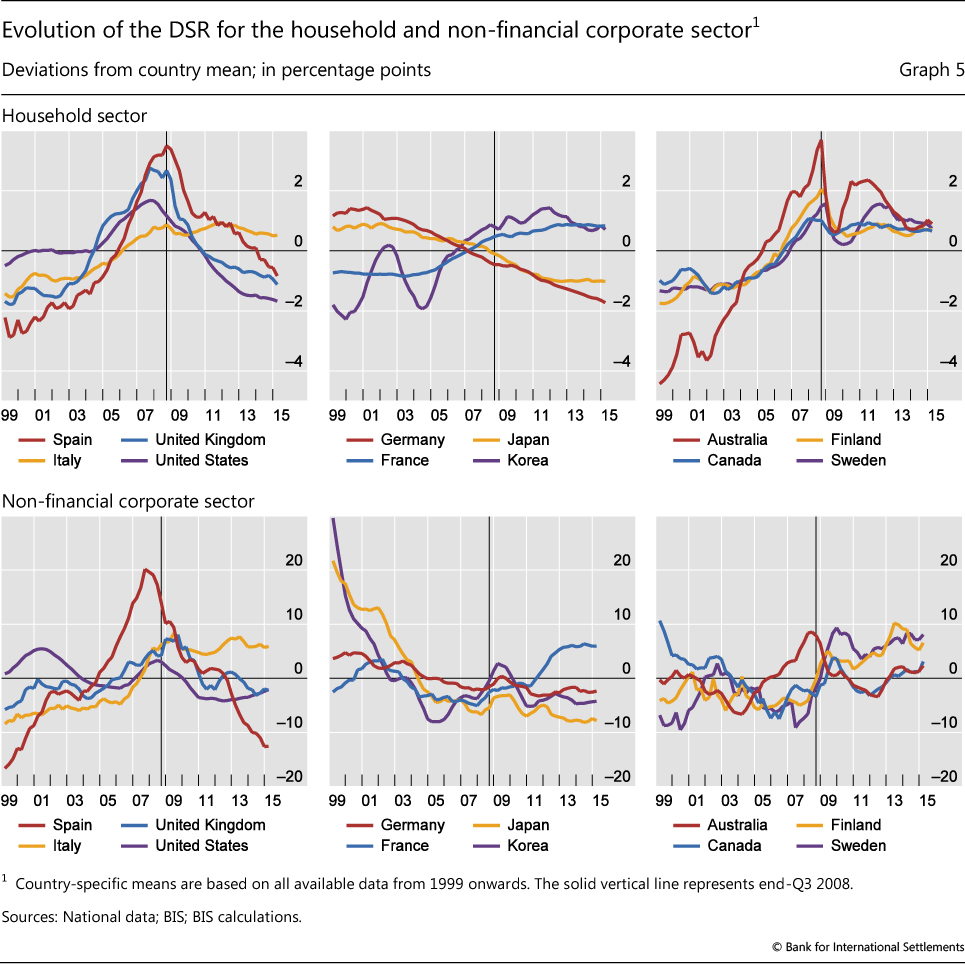

How Much Income Is Used For Debt Payments A New Database For Debt Service Ratios

Understanding Debt To Income Ratio For A Mortgage Nerdwallet